The Fraser Institute, an independent Canadian public policy research and educational organization has released 2019-20 report on how much debt, Canadian Federal and Provincial Budget deficits have accrued.

In the report, The Growing Debt Burden for Canadians, released by Fraser Institute warns that Canada’s combined federal-provincial debt will reach $1.5 trillion in 2019/20.

You may like: Health Care Wait Times

The study by Fraser Institute finds that, since 2007/08, the year before the last recession, combined federal and provincial debt has grown from $837.0 billion to a projected $1.5 trillion in 2019/20.

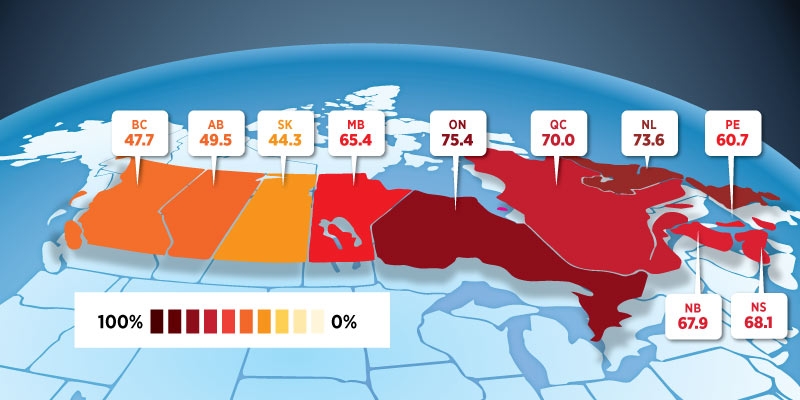

In 2019/20, Canada’s projected combined government debt ( federal debt and the provincial debt of all 10 provinces) will equal 64.3 per cent of the Canadian economy.

On a per person basis the combined debt is equal to $39,483 for every Canadian.

Amongst the provinces, Newfoundland and Labrador has the highest combined debt per person, equalling $48,478.

Ontario also has the highest combined debt ($668.5billion), and will equal 75.4 percent of Ontario’s economy (federal-provincial debt-to-GDP ratio, and the second-highest combined debt per person ($45,891).The report warns that it would take three out of every four dollars in Ontario’s economy to eliminate the province’s combined government debt.

At 44.3%, Saskatchewan has the lowest debt and Prince Edward Island has the lowest debt per person in the country with $28,394.

Credit: Fraser Institute

Jake Fuss, economist at the Fraser Institute and co-author of The Growing Debt Burden for Canadians, says, “As budget season approaches, governments across Canada should remember that deficits and debt today ultimately mean higher taxes tomorrow.”

You may like:

When debt increases, the interest payments increase. Governments must make interest payments on their debt similar to households that must pay interest on borrowing related to mortgages, vehicles, or credit card spending. As a consequence, there will be less money available for tax cuts or government programs such as health care, education, and social services.

Overall nominal net debt for the federal and seven provincial governments is projected to grow further in 2019/2020 which will pose significant problems for Canada’s tax-payers and public finances in the future.

You can read the complete report here.