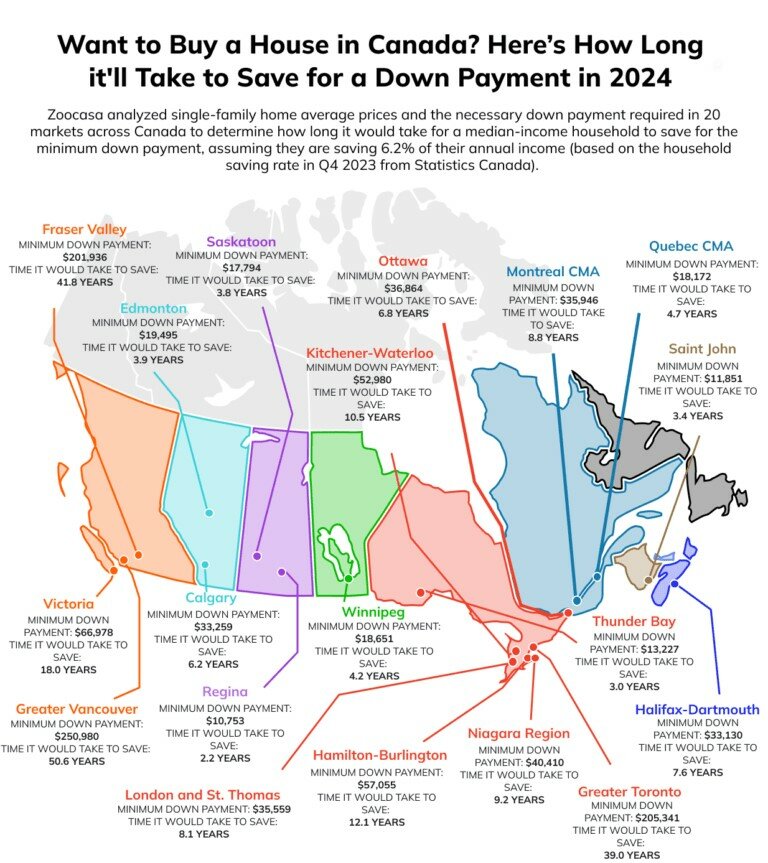

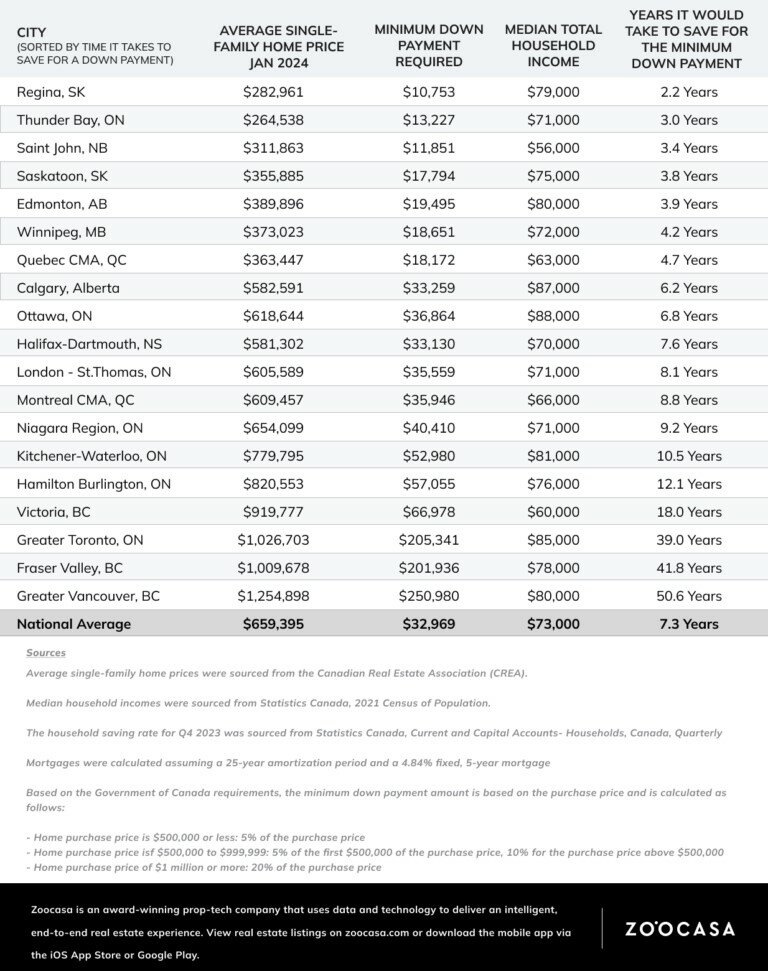

Zoocasa‘s latest study on the Canadian housing market reveals the time required for median income households to save for a down payment on a single-family home across 20 major cities, using a 6.2% annual savings rate and considering a 25-year mortgage with a 4.84% interest rate.

Credit: Zoocasa

According to the real estate firm, Regina and Thunder Bay emerge as the most affordable cities, where saving for a down payment takes approximately two years and two months, and three years, respectively. Regina’s average home price stands at $282,961, while Thunder Bay’s is $264,538, both significantly below the national average.

Saint John, Edmonton, and Saskatoon also offer relatively affordable housing options, with required saving periods ranging from just under three years and four months to under five years. Saint John’s average home price is notably lower than the national average, despite a median income 23% below the national median. Edmonton and Saskatoon feature higher median incomes and home prices well below the national benchmark.

The study identifies six cities where saving for a down payment takes five to ten years, with home prices also below the national average.

Winnipeg, for example, requires a saving period of four years and two months, with an average home price of $373,023. Calgary, with a higher median income, requires six years and two months to save for a down payment on a home priced at $582,591.

In contrast, Ontario and British Columbia present more challenging markets. The Hamilton-Burlington area requires over 12 years to save for a down payment, while Greater Toronto and the Fraser Valley in British Columbia demand upwards of 39 and 41 years, respectively. Greater Vancouver tops the list with a saving period of 50 years and six months for a down payment.

Credit: Zoocasa

The study suggests that for residents in higher-priced markets, considering smaller cities or alternative housing options like condos or attached townhomes, as well as pooling resources with others, could accelerate the path to homeownership.

More Information