A new study by Fraser Institute says high-income families pay a disproportionately large share of all Canadian taxes.

The study, Measuring Progressivity in Canada’s Tax System, aimed at understanding the fairness of Canadian tax system compares the share of income earned compared to their share of total taxes paid.

Fraser Institute study estimates the taxes that Canadians pay to federal, provincial, and municipal governments and uses family income as individual income is not the real indicator of a personal well being. The report puts someone with “$10,000 in income who is married to a person with $200,000 in income to a family that ranks among the top 20 percent of Canadian income earners”. Unattached individuals are considered to be families for the purpose of the study.

In the study, Canadian families are divided into five groups based on their total income with each group containing 20 percent of all families in the country:

- Bottom 20% with family income of $0 to $55,600.

- Quintile 2 with family income of $55,601 to $91,913

- Quintile 3 with family income of $91,914 to $138,698

- Quintile 4 with family income of $138,699 to $206,266

- Top 20% with family income of more than $206,267

The study finds the bottom 20 percent of families pay only 1.0 percent of all federal and provincial income taxes while receiving 5.5 percent of the total family income while the top 20 per cent pays 63.2 percent of all personal income taxes while receiving less than half of the country’s total family income.

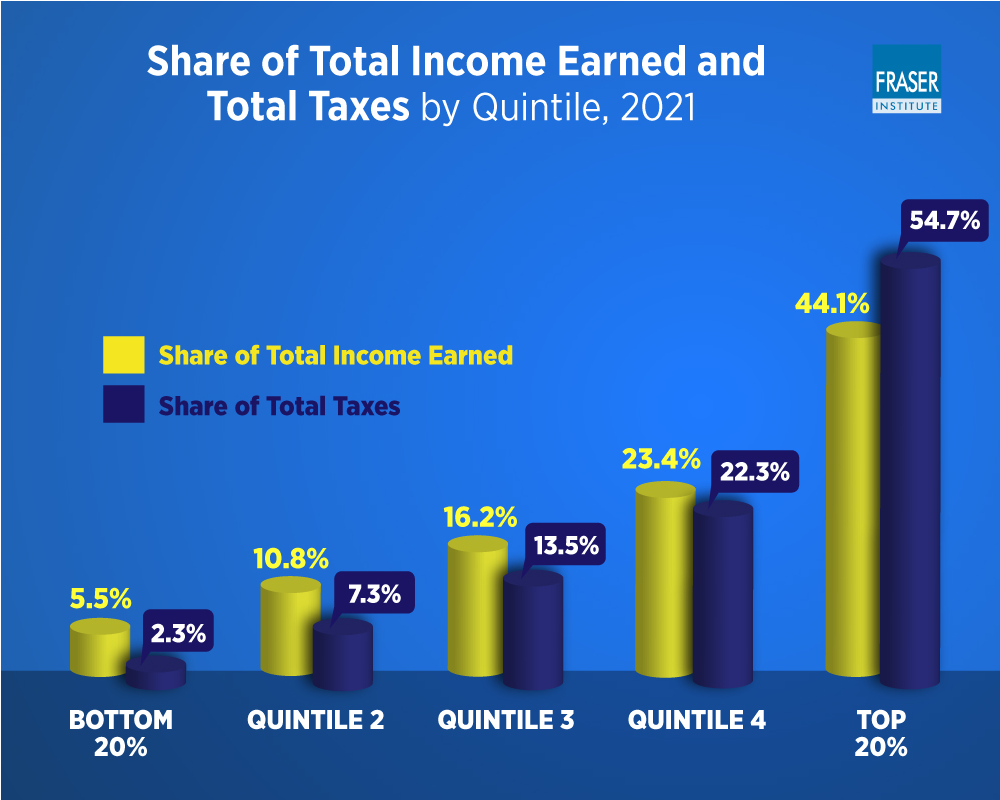

While comparing the share of total taxes paid (income taxes, sales taxes, payroll taxes, profit taxes, property taxes etc) the study finds that the top 20 per cent of income-earning families pay a 54.7 per cent of total taxes than their share of income at 44.1 per cent. While, the bottom 20 per cent of income-earning families pay 2.3 per cent of total taxes but earn 5.5 per cent of the total family income in Canada.

Measuring Progressivity in Canada’s Tax System study author Jake Fuss says, “The assertion that the top 20 per cent of earners in Canada are not paying their fair share is simply not supported by the evidence.”

The report concludes that despite the common misperception that top earners don’t pay their ‘fair share’ of taxes, the top 20 per cent of income-earning families is the only group to pay a disproportionate share of the total tax burden compared to their share of income earned.

You can read more on the study here.